You can check capital loss carryover worksheet 2016 to 2017. And To report a capital loss carryover from 2019 to 2020 Use this worksheet to figure the estates or trusts capital loss carryovers from 2020 to 2021 if. What are capital loss carryovers. 2016 Montana Net Operating Loss NOL 15-30-2119 MCA and ARM 4215318 ARM 4230106. Read also carryover and capital loss carryover worksheet 2016 to 2017 13IRS capital loss carryover Worksheet 2021.

Having taxable income on the 2017 return of zero of less than zero if an estate or trust complete Table 1 Worksheet for NOL Carryover From 2016 to 2017 It will help figure the NOL to carry to 2018 Keep the worksheet in records Center for Agricultural Law Taxation Carryforward Worksheet. To report capital gain distributions not reported directly on Form 1040 line 13 or effectively connected capital gain distributions not reported directly on Form 1040NR line 14.

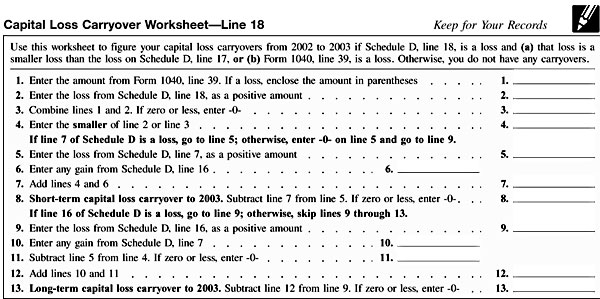

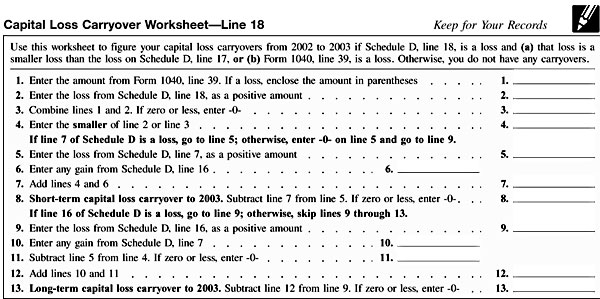

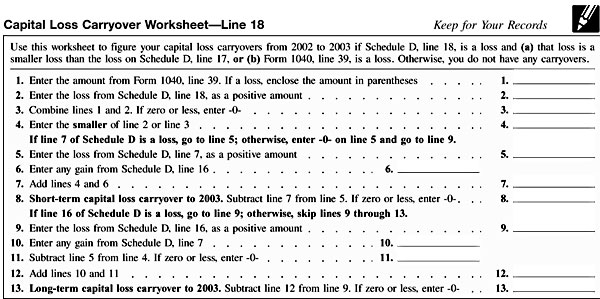

Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller Subtract line 7 from line 5.

| Topic: To report capital gain distributions not reported directly on Form 1040 or 1040-SR line 7 or effectively connected capital gain distributions not reported directly on Form 1040-NR line 7. Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Analysis |

| File Format: Google Sheet |

| File size: 2.6mb |

| Number of Pages: 20+ pages |

| Publication Date: April 2021 |

| Open Fillable Online Apps Irs Capital Loss Carryover Worksheet Irs Gov Fax Email Print Pdffiller |

|

6 Before You Start Who should use these instructions and.

Enter amounts here that reflect taxable income prior to the application of an NOL carryback from a future year adjusted accordingly for capital loss deduction. For each of 2015-2017 review your returns to determine if you applied a net capital loss from a prior year on line 253 of your tax return. CAT 2017 registration opened on August 9. Use the Capital Loss Carryover Worksheet in the 2020 Schedule D. If a loss enter -0-Subtract line 5 from line 4. 2To report a gain or loss from a partnership S corporation estate or trust.

Schedule D Tax Worksheet 2014 Nidecmege Look at Schedule D lines 15 and 16 of your 2019 tax return.

| Topic: If Schedule D lines 15 and 16 are losses then you might have a capital loss carryover to 2020. Schedule D Tax Worksheet 2014 Nidecmege Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Solution |

| File Format: Google Sheet |

| File size: 1.9mb |

| Number of Pages: 50+ pages |

| Publication Date: January 2021 |

| Open Schedule D Tax Worksheet 2014 Nidecmege |

|

2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf 3On an Excel spreadsheet or multi-column paper note any taxable capital gains you reported in 2015 2016 and 2017.

| Topic: Publication 550 Investment In e and Expenses Reporting Capital from Capital Loss Carryover. 2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Synopsis |

| File Format: PDF |

| File size: 2.1mb |

| Number of Pages: 55+ pages |

| Publication Date: January 2017 |

| Open 2016 Form 1040 Schedule D Edit Fill Sign Online Handypdf |

|

Capital Gain Worksheet 2015 Promotiontablecovers Capital gains capital losses and tax-loss carry-forwards are reported on IRS Form 8949 and Schedule D When reported correctly these forms will help you keep track of any capital loss carryover.

| Topic: Use the worksheet on the next page to igure your capital loss carryover to 2017. Capital Gain Worksheet 2015 Promotiontablecovers Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Synopsis |

| File Format: PDF |

| File size: 2.3mb |

| Number of Pages: 55+ pages |

| Publication Date: May 2018 |

| Open Capital Gain Worksheet 2015 Promotiontablecovers |

|

Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download If you have more capital losses than capital gains in previous years part of those losses may be carried over to your 2020 tax return.

| Topic: On nonbusiness capital losses ordinary nonbusiness. Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Answer Sheet |

| File Format: DOC |

| File size: 1.5mb |

| Number of Pages: 30+ pages |

| Publication Date: July 2020 |

| Open Fillable Schedule D Form 1040 Capital Gains And Losses 2012 Printable Pdf Download |

|

Schedule D Capital Loss Carryover Worksheet Line 18 If zero or less enter -0-Enter the loss from your 2016 Schedule D line 15 as a positive amount Enter any gain from your 2016 Schedule D line 7.

| Topic: If yes reduce the taxable capital gain on your spreadsheet by the loss applied. Schedule D Capital Loss Carryover Worksheet Line 18 Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Synopsis |

| File Format: PDF |

| File size: 1.7mb |

| Number of Pages: 5+ pages |

| Publication Date: January 2019 |

| Open Schedule D Capital Loss Carryover Worksheet Line 18 |

|

S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf Advanced Scenario 7 Quincy And Marian Pike Direct from Capital Loss Carryover Worksheet source.

| Topic: 8How To Figure an NOL Carryover6 NOL Carryover From 2017 to 20186 Worksheet Instructions7 How To Get Tax Help. S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Learning Guide |

| File Format: PDF |

| File size: 1.8mb |

| Number of Pages: 20+ pages |

| Publication Date: March 2020 |

| Open S 1040 Pdf 1040 Federal 2016 Fd Wk D Cg Capital Loss Carryover 16 Pdf |

|

2020 Form Irs 1040 Schedule D Fill Online Printable Fillable Blank Pdffiller Now I mention xxxxx carryover loss in short term from 2016.

| Topic: Your total net loss appears on line 21 of the 2020 Schedule D and transfers to line 7 of the 2020 Form 1040 that youll file in 2021. 2020 Form Irs 1040 Schedule D Fill Online Printable Fillable Blank Pdffiller Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Explanation |

| File Format: Google Sheet |

| File size: 810kb |

| Number of Pages: 4+ pages |

| Publication Date: February 2021 |

| Open 2020 Form Irs 1040 Schedule D Fill Online Printable Fillable Blank Pdffiller |

|

Tax Forms Irs Tax Forms Capital Gain 2To report a gain or loss from a partnership S corporation estate or trust.

| Topic: If a loss enter -0-Subtract line 5 from line 4. Tax Forms Irs Tax Forms Capital Gain Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Analysis |

| File Format: PDF |

| File size: 2.6mb |

| Number of Pages: 4+ pages |

| Publication Date: October 2019 |

| Open Tax Forms Irs Tax Forms Capital Gain |

|

Form 1041 Schedule D Capital Gains And Losses 2014 Free Download Enter amounts here that reflect taxable income prior to the application of an NOL carryback from a future year adjusted accordingly for capital loss deduction.

| Topic: Form 1041 Schedule D Capital Gains And Losses 2014 Free Download Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Analysis |

| File Format: DOC |

| File size: 1.6mb |

| Number of Pages: 7+ pages |

| Publication Date: March 2021 |

| Open Form 1041 Schedule D Capital Gains And Losses 2014 Free Download |

|

S Ftb Ca Gov Forms 2016 16 540nrd Pdf

| Topic: S Ftb Ca Gov Forms 2016 16 540nrd Pdf Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Solution |

| File Format: Google Sheet |

| File size: 810kb |

| Number of Pages: 20+ pages |

| Publication Date: January 2021 |

| Open S Ftb Ca Gov Forms 2016 16 540nrd Pdf |

|

Form 1040 Individual Ine Tax Return 2013 Brilliant Irs Gov Capital Gains Worksheet New Schedule C Tax Form 2018 4 19 15 Models Form Ideas

| Topic: Form 1040 Individual Ine Tax Return 2013 Brilliant Irs Gov Capital Gains Worksheet New Schedule C Tax Form 2018 4 19 15 Models Form Ideas Capital Loss Carryover Worksheet 2016 To 2017 |

| Content: Answer Sheet |

| File Format: Google Sheet |

| File size: 2.8mb |

| Number of Pages: 10+ pages |

| Publication Date: August 2017 |

| Open Form 1040 Individual Ine Tax Return 2013 Brilliant Irs Gov Capital Gains Worksheet New Schedule C Tax Form 2018 4 19 15 Models Form Ideas |

|

Its really easy to prepare for capital loss carryover worksheet 2016 to 2017 S ftb ca gov forms 2016 16 540nrd pdf schedule d tax worksheet 2014 nidecmege fillable schedule d form 1040 capital gains and losses 2012 printable pdf download form 1041 schedule d capital gains and losses 2014 free download form 1041 schedule d capital gains and losses 2014 free download form 1040 individual ine tax return 2013 brilliant irs gov capital gains worksheet new schedule c tax form 2018 4 19 15 models form ideas 2016 form 1040 schedule d edit fill sign online handypdf 2020 form irs 1040 schedule d fill online printable fillable blank pdffiller

0 Comments